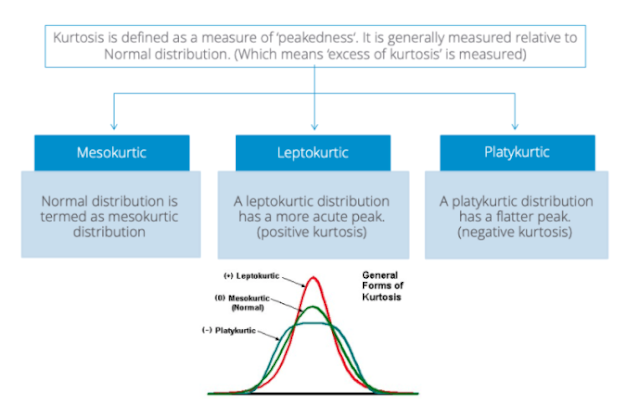

There is often talk about the distributions and deviations from normal for assets and macro variables. The discussion usually focuses on skew or whether there are fat tails, yet there can also other forms of peakedness or "tailness".

The form that is not often discussed is platykurtic where there is a flatter peak and more probability mass in the midsection of the distribution. There may not be large tail events - the Fed may stop the extreme, but there may be more event probability that is away from the average.

An interesting question is how an investor should change their allocations in a platykurtic environment versus a fat-tailed leptokurtic world. Perhaps when we think about macro fat-tailed events, we are really thinking about a flattening of the distribution and not a more peaked distribution.

No comments:

Post a Comment