A number of researchers have found that blending value and momentum is a good diversification strategy. Some have found that trend and value also work well together. The benefit from blending value and momentum premia returns comes from their negative correlation. Additionally, these two risk premia strategies have been proven to be the most consistent of all tested over long periods. These risk premia are time varying but have proven to be successful over long periods, across all asset classes, and across different countries.

So, what makes this combination of value and momentum so special? We can find the rational of the value and momentum combination through looking a number of traditional global macro risk factors that have been long identified as useful.

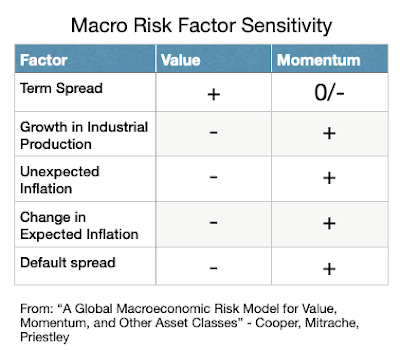

A useful set of global macro factors (variation of Chen Roll, and Ross 1986 factors) include: the term premium (identifies monetary policy and business cycle), the growth in industrial production (business cycle), unexpected inflation, change in expected inflation, and the default spread. The sensitivity of value and momentum risk premia to these macro factors are found to be the opposite signs. However, the sensitivities or strengths are different, so the macro factor effects do not cancel out return potential. These common macro risk factors will impact all asset classes and are associated with asset pricing anomalies.

A diversified portfolio that may include value and momentum risk exposures also has exposure to a set of global macroeconomic factors. An investor can change the tilt or mix between value and momentum based on their view to these macro factors. An investor that wants to hold different risk premia strategies should realize that he is holding different global macro factor exposures.

No comments:

Post a Comment