When will value strategies outperformance? There has been a long period of value underperformance versus growth, and value factor returns have continued to decline. Now we are seeing a recession with an overvalued equity market, so it seems normal to ask whether this economic combination will lead to a value strategy benefit.

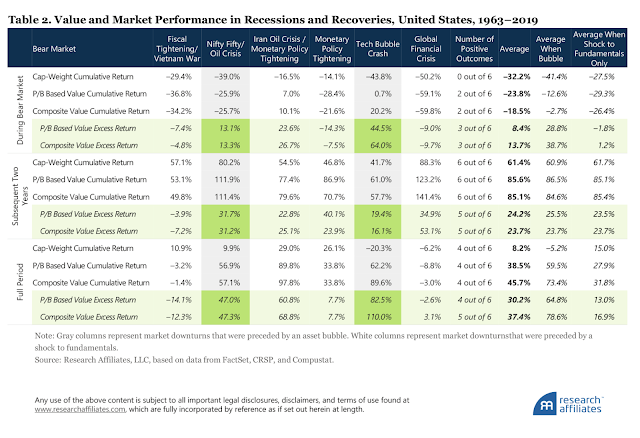

There just are not many bear market recession combinations, so there are only a few scenarios or cases that can be studied. The Research Affiliates folks, who always do high quality research, explored the potential benefits of value at key markets junctions like today by reviewing some past scenarios. See "Value in Recessions and Recoveries". They identify six key cases for study and break these into two types, fundamental driven and bubbles with fundamentals. This represents a very small sample, but it is still worth looking at the value strategy performance.

The results from looking at the bear market, the subsequent two years, and the full period shows that there is a better than 2/3rds chance of gaining excess returns from holding value over a cap-weighted index over the full period. If an investor focuses on value when there is a bubble and bear/recession combination, the return gains are even more significant.

Value compares well with other factor strategies especially if the market is in a bubble environment similar to what we may be facing today.

We have looked at the empirical research on the value strategy in a past post (see "Value is still not an investment opportunity". The current macro factors for value are not compelling, but the Research Affiliates scenario research suggests that a value strategy is worthwhile if we look into the future recovery.

There just are not many bear market recession combinations, so there are only a few scenarios or cases that can be studied. The Research Affiliates folks, who always do high quality research, explored the potential benefits of value at key markets junctions like today by reviewing some past scenarios. See "Value in Recessions and Recoveries". They identify six key cases for study and break these into two types, fundamental driven and bubbles with fundamentals. This represents a very small sample, but it is still worth looking at the value strategy performance.

The results from looking at the bear market, the subsequent two years, and the full period shows that there is a better than 2/3rds chance of gaining excess returns from holding value over a cap-weighted index over the full period. If an investor focuses on value when there is a bubble and bear/recession combination, the return gains are even more significant.

Value compares well with other factor strategies especially if the market is in a bubble environment similar to what we may be facing today.

We have looked at the empirical research on the value strategy in a past post (see "Value is still not an investment opportunity". The current macro factors for value are not compelling, but the Research Affiliates scenario research suggests that a value strategy is worthwhile if we look into the future recovery.

No comments:

Post a Comment