Momentum has proven to be an effective strategy that has shown consistency over the long-run, but it is not without risks - turning points. One of the most informative papers on momentum and the risks of turning points was produced late last year, but this work has not been given enough attention. See "Momentum Turing Points" by Garg, Goulding, Harvey, and Mazzoleni. This is an exhaustive work on turning points and momentum strategies but is an easy read and provides a clear picture of the return and risk potential for time series momentum portfolios.

This paper's elegance is with its simplicity. The authors look at the simple combination of fast (1-month) and slow (12-month) momentum models. If the two strategies are positive (negative) and in agreement, the market is in a bull (bear) environment. If the fast is negative (positive) and the slow momentum is positive (negative), the market is in correction (rebound). The market can be classified as being in one of these four phases. These states actually can be translated to different economic regimes, risk environments, and survey surprises. Hence, momentum can be associated with different economic states and risk appetites.

Some of the interesting findings from this research:

1. Intermediate speed momentum strategies will have a higher Sharpe ratio than slow or fast strategies.

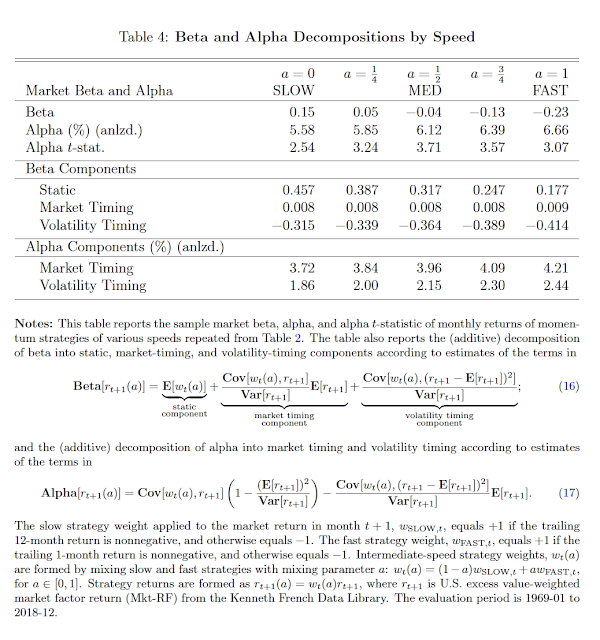

2. Momentum strategies at all speeds have a positive average exposure (long over short positions), but market betas are lower than expected with slow and intermediate betas being close to zero and fast speeds showing negative beta estimates.

3. The alpha from momentum strategies can be divided into market timing and volatility timing with market timing representing 2/3rd of the alpha and 1/3 associated with volatility timing.

4. The momentum strategies show varying tail risk benefits base on their ability to adjust to corrections and rebounds.

5. Turing points from up to down have properties different than turning points that move from down to up. There is more likelihood of type I errors (false alarms) during a correction while there will be a missed detection or type II error during rebounds. These properties can be exploited by a dynamic strategy between fast and slow momentum.

5. These momentum results hold across international equity markets.

We can stop with all of talk about crisis alpha or discussion about the special features of trend-following as if there is some return magic. Follow some simple momentum, learn to get out of the way during corrections and rebounds and just be disciplined. Regardless of turning points, this is a great simple way to run a portfolio.

No comments:

Post a Comment