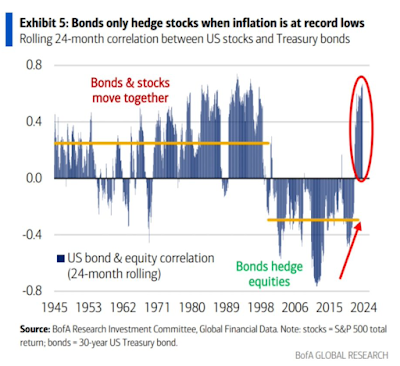

I always come back to this key chart, the correlation between stock and bonds. We have ended the great period of diversification, the 60/40 era. This correlation switch is the ultimate diversification regime shift. From this relationship comes all other diversification decisions. You don't have as great a need for alternatives when the stock bond correlation is negative. Investor search for diversification should be at a heightened level. This correlation is not going back to negative anytime soon.

No comments:

Post a Comment