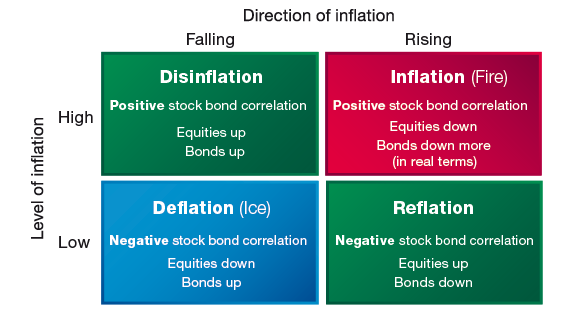

The worst asset allocation situation for investors is when stocks and bonds are correlated, and both are heading down. The situation is especially disruptive if bonds are falling faster because fixed income is supposed to be the safe asset. This correlated scenario occurs when the economy is in a high and rising inflation environment. We have seen this bad inflation environment in 2022. We are now in a high but falling inflation environment which also has a positive correlation, yet stocks and bonds are both moving higher.

With the PCE core inflation showing sticky behavior at 4.6% YOY, the promise of lower inflation may not be as strong as suggested even two months ago. Investors must ask where they are positioned within the inflation matrix and where may the market be in six months. This will provide answers to the correlation environment and what will be the diversification expected between the two major asset classes.

No comments:

Post a Comment