Monetary policy will impact financial risk sentiment; that has generally a good thing during the post-GFC period. However, any strong swings in sentiment can also lead to longer-term economic problems when these sentiments reverse. If sentiment reaches an extreme and then changes, there can be a negative impact on financial markets and the real economy as higher risk premium are reflected in prices. Hence, central bankers must be aware of their impact of sentiment and temper market extremes. See "Monetary Policy When the Central Bank Shapes Financial-Market Sentiment" by Anil K Kashyap and Jeremy C. Stein.

Sentiment is a real current problem for the Fed and is one of the reasons why Chairman Powell spends so much time at his press conferences trying to ensure that markets have the right message. First, you don't want markets to make mistakes based on false beliefs, and second, you don't want risk tolerances to not reflect the true impact of the Fed actions. The objective is to not have sentiment change or move to an extreme that will constrain or negative impact future Fed policy.

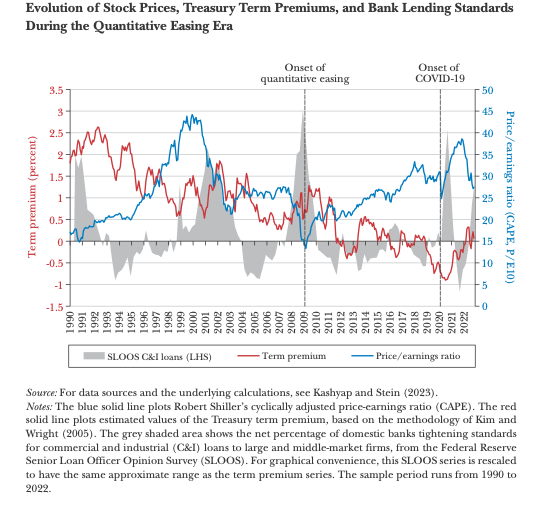

Sentiment can be viewed as the change in time-varying risk premium across assets; a greater desire to hold risky assets will lower risk premiums as asset prices are bid higher which will lead to lower future returns, or behavior that will be turn overly optimistic or pessimistic. Rapid credit growth, elevated asset prices, and lower risk premiums are all signs of strong risk sentiment that could be influenced by the Fed.

There is growing work that links monetary policy to risk sentiment across all asset classes. An increase in short-term rates will lead to higher Treasury term premium. Stock risk premiums and volatility will change with the looseness of monetary policy. Credit spreads will move with credit availability and pricing from banks. The value of the dollar will be influenced by relative bond term premiums and a sense of financial safety.

The graph above shows the change in risk premium across some major assets. The decline of risk sentiment is notable during the period of QE. Hence, a return to normal from rising rates will be more involved than just raising the discount rate. There is an added complexity of changes is risk sentiment that will weigh heavily on markets.

No comments:

Post a Comment