What have we learned about managed futures in the last year?

We cannot say that this is applies to trend-followers since managed futures is a broader category than trend strategies bur the majority of AUM is trend-based.

Over the long-run, managed futures returns are similar to the hedge fund industry. The alpha is consistently higher given the low beta most of these strategies have relative to the hedge fund industry.

When there is a bear market or a market disruption that lasts for more than a quarter, managed futures will be significantly higher than hedge funds. They are supposed to both be diversifiers, but managed futures will have more concentrated returns during a crisis.

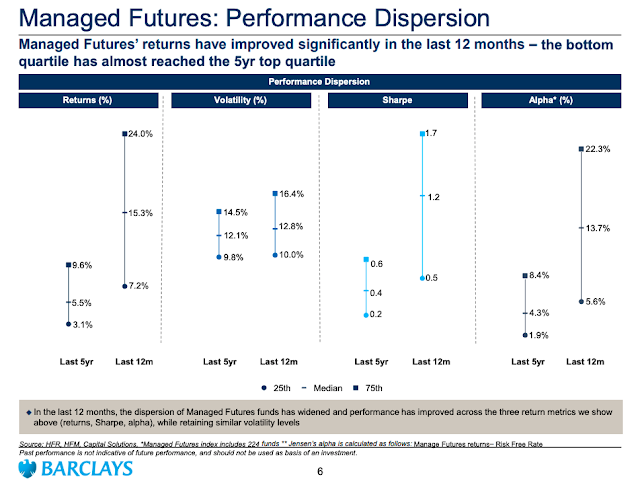

The volatility of managed futures funds will increase during a crisis, but given MF managers many target volatility, the range is close to historical norms. However, there is a significant dispersion in return and Sharpe ratios with the range multiples higher.

Hold managed futures for a bear market environment but diversify across several managers given the large dispersion during turbulent times.

No comments:

Post a Comment