Learning to be smarter and run faster is a core part of the hedge fund business. Markets are fairly efficient, so there is always a desire to find an edge. And, if you have an edge, you have to accept that it may not last, so you should be looking to enhance the edge or look for a new one. There are several ways managers can create an edge:

1. Information advantage - get new and better information. This is a big new business with new alternative data sets.

2. Processing advantage - Look at information differently.

3. Operational advantage - Be faster at trading and operational efficiencies

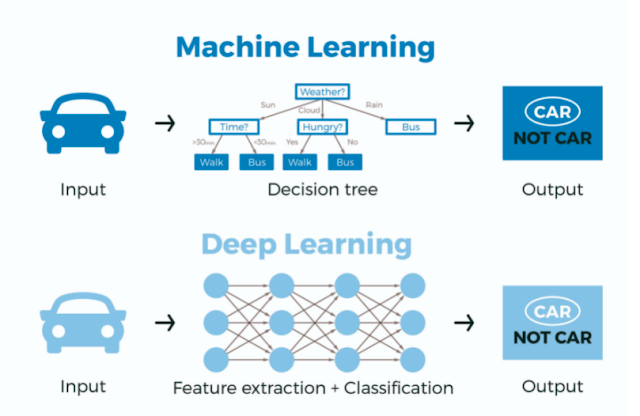

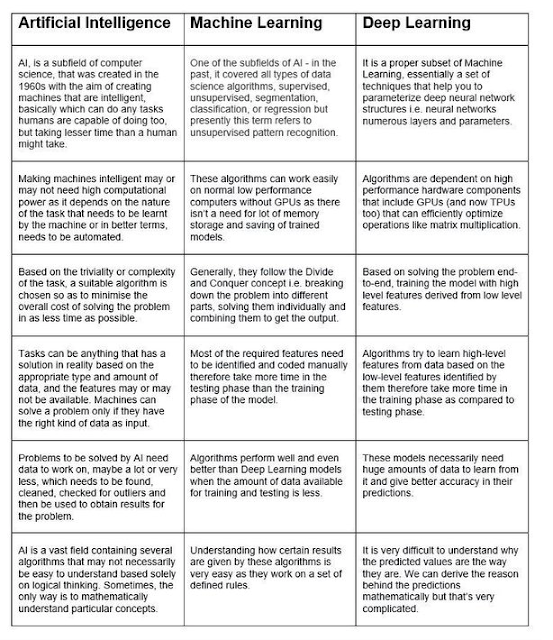

Machine learning and deep learning are focused on generating an information processing edge, yet they approach the processing edge problem in very different ways. It is important to understand the difference between the two.

Machine learning is directed by the analyst, so the process edge starts with the quality of the analysts who is picking the features being used in a model. Deep learning is not driven by the feature choice of the analyst but by the data processing of the information and the ability of the model to extract relationship. The expertise with deep learning is on raw processing as opposed to managing relationships of curated information.

Is one approach better than another? My preference is with machine learning and using expertise to focus algorithm construction on key features. Deep learning can generate unique insights but will not have the important feature of explainability. Press on explainability and core features before resorting to deep learning classification.

source: Bismart.com

source: Artificial Intelligence Solutions | USM

source: Anil Gupta

No comments:

Post a Comment