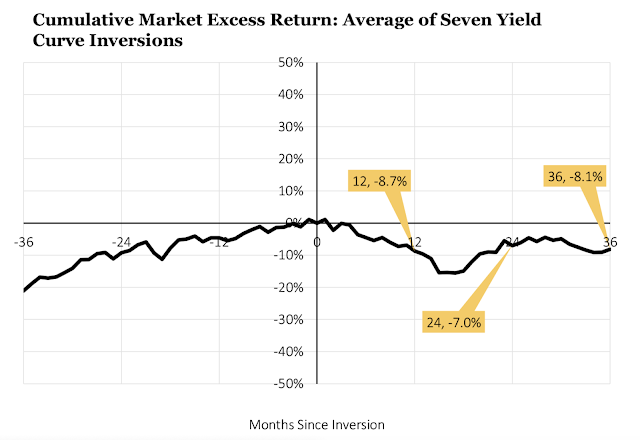

Cam Harvey of Duke University was interviewed by his partners at Research Affiliates on the impact of the yield curve inversion on stock returns. The numbers are not attractive. Conducting a simple event study of the seven inversions since the 1960's, Harvey shows that excess returns are negative on average for three years. There have been yield curve inversions where stocks have moved higher but this is not something an investor should bet on. Only the 1978 inversion showed positive cumulative excess returns for all periods after the inversion. Two of the seven inversions ended with positive cumulative excess returns at the end of three years.

The odds are stacked against equity investors. As researched by Harvey in his 1980's work, the real yield curve provides important information on future consumption. An inversion negatively impacts consumption growth, so the smart bet is to lower overall risk and focus on other asset classes or alternative investments. The numbers show that there is not an immediate link between inversion and stock declines but investors should realize that any delay in adjusting portfolio allocations will be costly. Unfortunately, the natural flight to bonds may also be a risky bet, so investors will have to think about a broader set of alternatives.

No comments:

Post a Comment