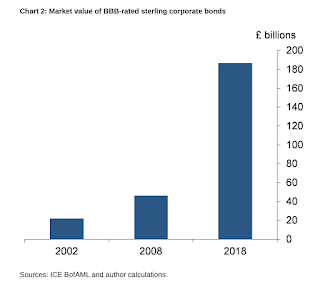

The Bank of England in their Bank Underground blog, commented on the growing risks with corporate bonds. Their risk concerns are the same as has been voiced in the US. First, the percent of BBB-rated sterling bonds are on the rise. Second, the market structure makes for more risk through a mismatch between assets and liquidity needs of investors. In the case of sterling bonds, there are increased risks from BREXIT.

It is interesting that central banks are sounding an alarm about the growth of riskier credit around the globe when this was exactly what they wanted with lower interest rates. High quality credits can always borrow and in many cases do not need the money. Lower quality firms are more sensitive to lower interest rates and will respond to cheap financing. Lower rates will also create the demand for riskier bonds as investors chase yield. Should we be surprised?

Since equities have softened this month, it is notable that BBB-rates spreads have increased by about 10 percent. This may not be enough to scare investors, but it is a sign that investor desire for risk is sensitive to this asset class.

No comments:

Post a Comment