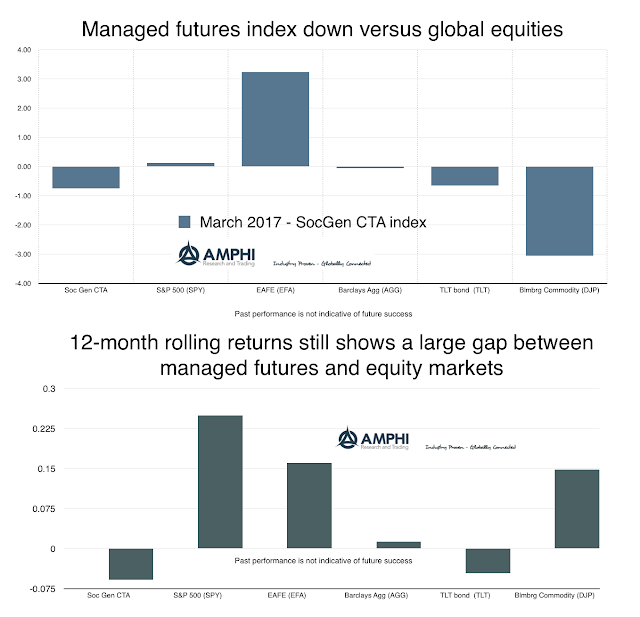

Managed futures declined on market reveals from the Fed FOMC announcement of a 25 bps rate hike. While the move seemed to have been baked into market thinking before the announcement, key asset classes revised trend direction after the 15th. The SPX, which was already flattening in trend, turned lower. Bond returns, (long duration), actually turned higher on a perceived more aggressive Fed. The dollar strength reversed and commodities moved higher after declining for the last month. You get the picture on the change. Trend-followers saw a reversal in performance which added to a lower overall return.

Looking only at monthly asset class return numbers will not show the trend reversal although a poor bond and currency month and declining commodity prices will provide a good tip that managed futures would not post a positive gain.

The gap between managed futures and equities is especially wide on a 12-month rolling average because the first quarter last year was so poor for equities. We expect the return gap will start to close as equity returns are normalized and managed futures finds better opportunities with the end of the post-Trump reflation euphoria period.

No comments:

Post a Comment