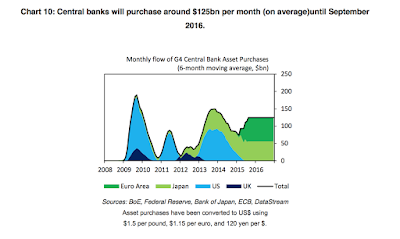

Central bank liquidity has been the name of the game around the world since the Financial Crisis. Financial markets have been addicted to central bank liquidity. It is less clear whether real markets have the same addiction; nevertheless, financial prices will move with expectations on the changes in liquidity.

Liquidity, however, is not the same across countries. Liquidity from the reserve currency countries will have a greater global effect. The Fed and BOE may have stopped but others are adding, but these additions to liquidity will have more localized effects. A yen or euro of added liquidity may not affect EM growth the same way an increase in dollars. Similarly, an increase in Chinese money will not have the same financial effect as an Euro increase. It will drive China growth which will channel through trade but will have a smaller impact on capital flows. Liquidity may still be higher in 2016, but the mix will be different. This is obvious but still important.

Additionally, on a global basis, we have actually seen a slight decline in foreign exchange reserves which affect high-powered money. When foreign reserves are used to support a currency, there is a decline in liquidity. This gets us to the bigger issue with central bank liquidity. When money can flow around the globe, the liquidity effects are much harder to determine or measure.

No comments:

Post a Comment