There are two things you want more than anything from hedge funds, diversification, and non-linear returns. These are closely tied together, but I would suggest that the key unique feature is non-linear returns. Making it sound simple, we want positive returns when traditional markets are going up and positive returns when they are going down. This is positive up market beta and negative down market beta.

This profile should be the standard of success for hedge funds if you want to add something different to your portfolio return mix. Non-linear returns is the essence of good diversification. The non-linear returns will drive correlation closer to zero when you combine up and down market periods.

This profile should be the standard of success for hedge funds if you want to add something different to your portfolio return mix. Non-linear returns is the essence of good diversification. The non-linear returns will drive correlation closer to zero when you combine up and down market periods.

So what strategies will have the quality of non-linearity? This is not actually easy to test given the the wide variety of strategies and asset classes employed. It is not like all managers try to generate option like returns against the stock market. There has been work that provides some good idea of what strategies may be special by looking at optionality across different asset classes. They test for the optionality of a fund relative to key beta exposures.

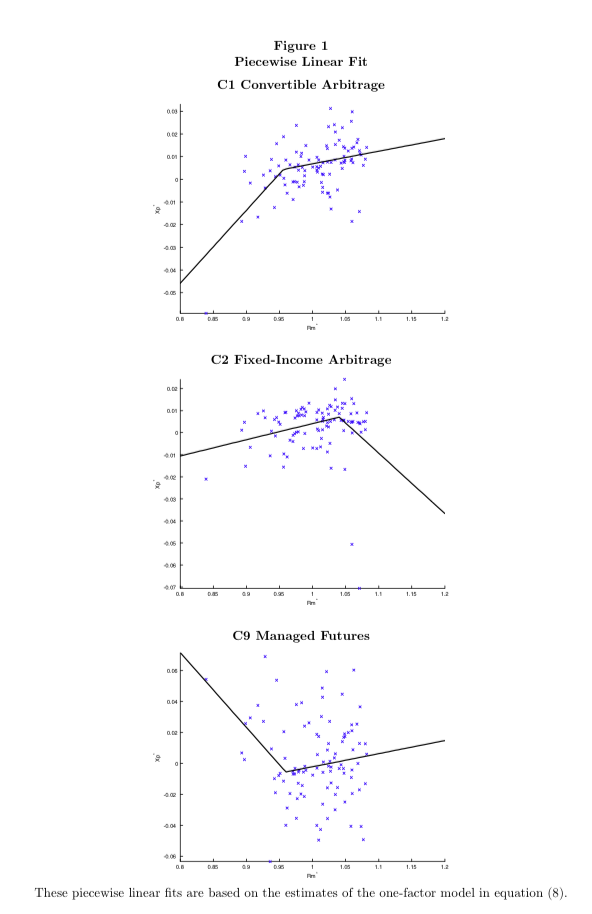

The figure below is from the paper, "Assessing and Valuing the Non-linear Structure of Hedge Fund Returns" by Antonio Diez de los Rios and Rene Garcia. It is a little dated but still provided some important insights. It shows three strategies which have non-linear return pay-offs. Investors should love managed futures if they want to make money in the extremes. As expressed by other researchers, the pay-off looks like a straddle.

If you are worried about the stand-alone returns of managed futures, the addition of fixed income arbitrage is almost the perfect match. Convertible bonds are also a good strategy mix. The alpha for each strategy is different. Fixed income arbitrage behaves like a selling a straddle. The authors are able to also show that not all funds within a strategy will have these characteristics.

Managed futures provide optionality against asset classes but may not generate a traditional alpha. The optionality value should be fine if you understand why you are holding managed futures. The diversification value driver is the non-linearity and not the alpha generation.

If you are worried about the stand-alone returns of managed futures, the addition of fixed income arbitrage is almost the perfect match. Convertible bonds are also a good strategy mix. The alpha for each strategy is different. Fixed income arbitrage behaves like a selling a straddle. The authors are able to also show that not all funds within a strategy will have these characteristics.

Managed futures provide optionality against asset classes but may not generate a traditional alpha. The optionality value should be fine if you understand why you are holding managed futures. The diversification value driver is the non-linearity and not the alpha generation.

The research suggests that there is significant differences within a category. All managed futures funds are not alike. Some provide non-linear returns and other do not, so due diligence needs to occur to find out if the pay-off desired is secured with a given fund manager. The broad generalizations, however, point investors in the right direction for better diversification.

No comments:

Post a Comment