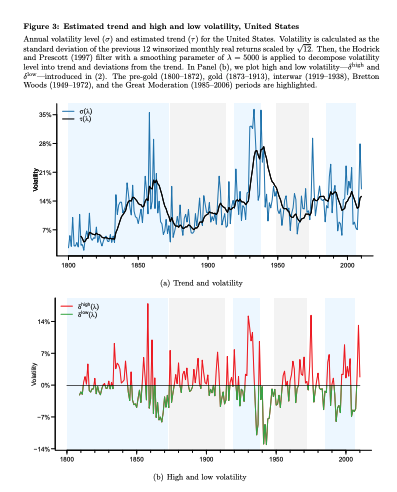

Volatility is a key driver and indicator for financial crises. This volatility prediction is not what you may expect. It is known that during a financial crisis volatility will surge higher, but what is critical for determining whether there will be a crisis is the past volatility.

What has been found is that a period of low volatility or calm markets will lead to future financial disruptions. This can be viewed as a verification of the Minsky instability hypothesis. See "Learning from History: Volatility and Financial Crises".

You could call this the "volatility paradox", low volatility will increase the chance of systemic event. If there is prolonged low volatility, there will a higher likelihood of a banking crisis. Form a low volatility regime, there will be excessive credit build-ups and higher balance sheet leverage. You feel like there is less risk and you will then take on more leverage. This work finds that "stability is destabilizing".

Given the long history studied and the long lag periods, it is hard to use low volatility as a trading signal for short-term shocks, but this volatility relationship is important when thinking about long-term crisis risks. Low volatility will cause investors to take bigger risks. The costs of these risks will have to be borne by someone.

No comments:

Post a Comment