"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Saturday, November 30, 2024

Lord Kelvin's dictum on measurement - applies to finance

"NIllius in verba" - "take nobody's word for it" especially in finance

The motto of the Royal Society, which is the science academy of the United Kingdom has a useful motto "Nillius in Verba" which is Latin for "take nobody's word for it". Science is not settled but is dynamic and to disprove the conjectures of the present.

This motto is a useful guide for assessing all of the ideas and works that are done in economics and finance. Do not follow the story, follow the numbers. Live in a skeptical world when there is money involved.

Friday, November 29, 2024

Categorize EM before running analysis

The weak link between EM returns and growth

China GDP and investor returns - the big disconnect

Thursday, November 28, 2024

The big rate breakout in historic context

There are short-term, medium, and long-term trends, but these are all usually inside a half a year for most trend-followers; nevertheless, it is good to focus on the very long-term to get a sense of the regimes that dominate the market view. If you look at trends over the last few decades, you will the great upward move of the 70’s and the 40+ year downtrend. The shorter-term cyclical credit trends show rates going up only with the market being hit with crisis which causes a reversal. Each shorter-term peak is at a lower high, but the chart is not the end of the story because we have not included the added two year period to November 2024. Look at the current level of 4.30 is way outside what anyone was thinking given the long trade. The last two years has been the great bond yield breakout and is nothing like we have seen in terms of a reversal of the bond channel. Discussion should always start with the new world bond view.

The dollar trend is consistent with macro trends

The Fed is easing albeit less than what was expected eve three months again and the rest of the world seems to be willing to ease more than the US. The result has been a stronger dollar that is on the high end of the range for the last two years since the easing cycle began. This does not seem surprising. The US economy is stronger than expected, inflation has come down, and longer-term interest rates are more attractive to foreign investors. There is little reason for a dollar reversal even without accounting for tariffs and a new administration.

The dollar trend is consistent with macro trends with provides more confidence in this price move.

The link between earnings, market returns, and GDP is not strong

One of the key problems with macro equity investing is that the link between earnings growth, market return and GDP growth are not often in lockstep. The chart shows that in the US earnings and market growth has been significantly higher than GDP growth, yet in many countries earnings and market growth have not been able to keep up with GDP growth. The link between GDP forecasting and market and earnings forecasting is not strong. You can be a great macro forecaster but that does not translate into making money in the equity markets.

Saturday, November 23, 2024

Fractal Markets Hypothesis as an alternative to efficient markets

We know that the efficient markets hypothesis as originally positioned by Fama is not true. The behavioralists put a stop to the idea that markets are always rational and embed all information in prices, so good science requires an alternative hypothesis or a different way of thinking about how markets use information and generate price dynamics. We have earlier mentioned one alternative "The Discovering Markets Hypothesis - Worth a close look to add to our thinking of market dynamics" which focuses on how competing narratives impact prices. Another alternative has been developed by Edgar Peters who focuses on fractals and the fact that different investors have different time horizons that change with uncertainty. The fractal approach has merit when looking for regime shifts but may be harder to explain the day-to-day movements in price. The work of Peters has been around for some time yet has not taken hold. Neither has the work associated with Discovering markets. We will have to wait while further work is developed.

The Fractal Markets Hypothesis of Edgar Peters states:

- The market consists of many investors with different investment horizons.

- The information set that is important to each investment horizon is different. The longer-term horizons are based more upon fundamental information, and shorter-term investors base their views on more technical information. As long as the market maintains this fractal structure, with no characteristic time scale, the market remains stable because each investment horizon provides liquidity to the others.

- When long-term investors begin to question the validity of their information, their investment horizon shrinks, making the overall investment horizon of the market more uniform.

- When the market’s investment horizon becomes uniform, the market becomes unstable because trading becomes based upon the same information set, which is interpreted in a more uniform way. So good news causes increased buying while bad news results in increased selling.

- Liquidity dries up, causing high volatility in the markets, because most of the trading is on one side of the market.

- Eventually the long term becomes more certain and stability returns to the market as investment horizons broaden and become more diverse.

- During periods of low uncertainty, markets will exhibit well-behaved, finite variance statistics. In high uncertainty environments, markets will exhibit fat-tailed risks and unstable variance more associated with the stable Paretian distribution as described by Mandelbrot (1964).

Friday, November 22, 2024

"Inflation is a social phenomenon" - Not quite

"Inflation is a social phenomenon," Powell said. "If people believe that inflation will be higher, then it probably will be. And if they believe that inflation will come down, then people who make and take prices and wages, they will make sure that it does come down. So, it's absolutely critical that we be credible."

- Powell press conference

Should we give him the benefit of the doubt or just call out the craziness of this comment. Of course, inflation is effected by expectations but where do those expectations come from? Perhaps the Fed itself as the the producer of money!

You cannot just say that if you believe something, it will happen. Are expectations always rational? No. is a component of inflation expectations backward looking? Yes. However, if you are the head of the Fed, you have to take responsibility for your actions.

Thursday, November 21, 2024

The Discovering Markets Hypothesis - Worth a close look to add to our thinking of market dynamics

Facts influence subjective knowledge which is then shared with others through narratives. These narratives compete with others through their influence on prices. Prices, of course, will then provide feedback on the quality of the narrative. As subjective knowledge changes, there will be an impact on prices. Facts or new information will drive the changes in subjective knowledge. Because subjective knowledge cannot be counted or measured with certainty, there will be inherent uncertainty in markets which will cause prices to change in ways that are not always expected.

The wild card for bond yields - the term premium

Treasury yield have moved higher while the Fed has lowered interest rates. This was not supped to happen. The question now is determining what is the fair value for Treasury yield out the curve. The usual method is to determine the real rate of interest which usually is about 2% plus some estimate of expected inflation which can be argued to be at level above 2%. So, if we use a real rate of 2% and an inflation rate of 2.5% we are at 4.5% as a good starting point; however, we need to add a term premium for the risk from holding these bonds out the curve. That number has been negative for an extended period but is now positive and rising. The current term premium is at the highest level in over a year; however, a longer history suggests that it can increase by a multiple of the current levels. One reason could be the lower liquidity in Treasuries, yet the recent fall is not seen in the term premium. Forecasting the term premium is now the Treasury yield forecast will card.

Trend-following with industry groups - It works

In the paper, "A Century of Profitable Industry Trends" the authors explore long-only trend following for a 48 industry portfolio for just under a one hundred year period. They find that the simple trend timing strategy will lead to higher returns, lower volatility, higher Sharpe ratio and less downside risk. This strategy is easy to implement and is shown to work with sector ETFs with a smaller portfolio of 31 industries. The numbers are compelling and again show that a trend strategy can be effective. The strategy is effect with equal weighting, timing and sizing allocations. It may not work during every period, but the long run return beat the simple strategy of holding the market portfolio.

Friday, November 15, 2024

There is no equity risk premium!

Wednesday, November 13, 2024

Replicating trend-following beta is achievable

VIX and corporate bonds

The economics of information - a history which leads to narrative information

Ways of thinking about news narrative that can be quantified.

Trend-following with stops reduces drawdowns

A core question with any trading strategy is whether or not to use stops. The answer is not always clear. It is clear that having stops too close will reduce return because many good positions are lost to reduce risk, it is often an empirical question of the value of this risk management tool. A recent paper set-up a simple model across all major assets classes to determine the value of stops. This work is not definitive and is just an example, but it does add to the discussion. See "Cross-asset trend following algorithm".

I will not go through all of the assumptions to get these results, but the base model represents a long-term trend model based on a moving crossover model using 50 and 100 days with stops based on a multiplier using the average true range. The data includes 39 assets over a 32-year period.

For the long/short portfolio there is a slightly lower Sharpe ratio when stops are used, but there is a significant decline in the maximum drawdown. A stop-loss will not support higher returns. A review of the cumulative returns chart shows a marked difference in the return pattern.

Tuesday, November 12, 2024

Risk cycles and the business cycle - Form low risk comes growth but also greater credit risk

Saturday, November 9, 2024

VIX and the equity markets - equities drive volatility

Trend-following in high and low rate regimes

Using our experiences is not always good

Follow our experience because as we gain more experience, we become better at making decision. Our wisdom comes from our experience. The Myth of Experience: Why we learn the wrong lessons and ways to correct them by Emre Soyer and Robin Hogarth is another take on behavioral mistakes and the problems of psychology on our decision-making. Their conclusion is that we often take-away the wrong conclusions from our experiences. Experiences that are no assess and filtered will give you the wrong answers. More experiences with the wrong assessment will make you a worse decision-maker. we use experience through linking our actions with results, but if there is not close link between the two, we will find a connection that is often wrong. The authors start with a great example. Learned people used bloodletting for centuries because they thought it worked. You bleed as a cure for a sickness and survive. It must have been the bloodletting that worked.

We often forget or don't think about what is missing from our experiences. We do not account for the irrelevant.

Robin Hogarth recently died, and this was one of his last books. He was one of the great researchers on decision-making and human behavior. Tversky and Kahneman have received most of the attention in this area, but Hogarth was a critical researcher in this area one the last 50 years.

Wednesday, November 6, 2024

Volatility is a driver for financial crises (Minsky low volatility)

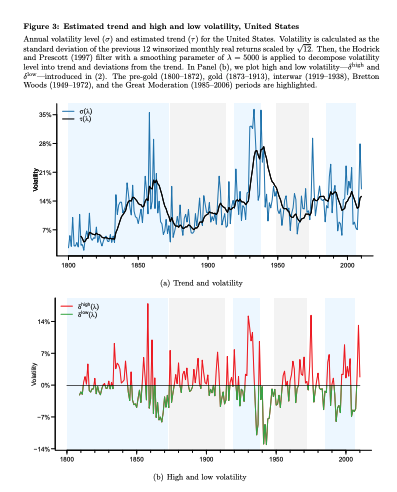

Volatility is a key driver and indicator for financial crises. This volatility prediction is not what you may expect. It is known that during a financial crisis volatility will surge higher, but what is critical for determining whether there will be a crisis is the past volatility.

What has been found is that a period of low volatility or calm markets will lead to future financial disruptions. This can be viewed as a verification of the Minsky instability hypothesis. See "Learning from History: Volatility and Financial Crises".

You could call this the "volatility paradox", low volatility will increase the chance of systemic event. If there is prolonged low volatility, there will a higher likelihood of a banking crisis. Form a low volatility regime, there will be excessive credit build-ups and higher balance sheet leverage. You feel like there is less risk and you will then take on more leverage. This work finds that "stability is destabilizing".

Given the long history studied and the long lag periods, it is hard to use low volatility as a trading signal for short-term shocks, but this volatility relationship is important when thinking about long-term crisis risks. Low volatility will cause investors to take bigger risks. The costs of these risks will have to be borne by someone.

Tuesday, November 5, 2024

Using the TIMEMIXER approach for volatility forecasting

An application of time mixing for volatility forecasting can be an important advancement for risk management. Research has extended the work on GARCH to an extreme, but there may be other techniques in time series forecasting that can be applied to financial time series that may be very useful. A recent paper focused on TimeMixers which employs different time scales as a method to improve forecasts. See "Volatility Forecasting in Global Financial Markets Using TimeMixer".

The idea behind TimeMixers is straight-forward. There is imbedded in any times series relationship with different timeframes that can exploited. There can be long-term seasonality. There can be cycles or trends that are longer than a few days that will not be captured with daily data. Classic time series in ARMA models can handle seasonality and can identify autocorrelation at different lengths, but a more explicit breakdown of data may improve forecasts.

I like the technique used and the author applied it to a broad set of markets, but I was disappointed that there was no testing against other types of models for volatility. This process looks interesting but it is not clear it is any better than what we already have. The MAE, MSE, and RMSE all are low especially for short-term forecasts, but the quality of technique must be balanced with the results, the ease of understanding, and the ease of implementation. This paper does not make that strong relative case for TimeMixer ML.