The paper "Commodity Futures Return Predictability and Intertemporal Asset Pricing" is another study that connects macroeconomic behavior to commodity returns. If you track key variables that proxy for the business cycle, you will be able to generate significant out-of-sample returns. These predictions are structured in a Merton-type inter temporal asset pricing model which is consistent with theory.

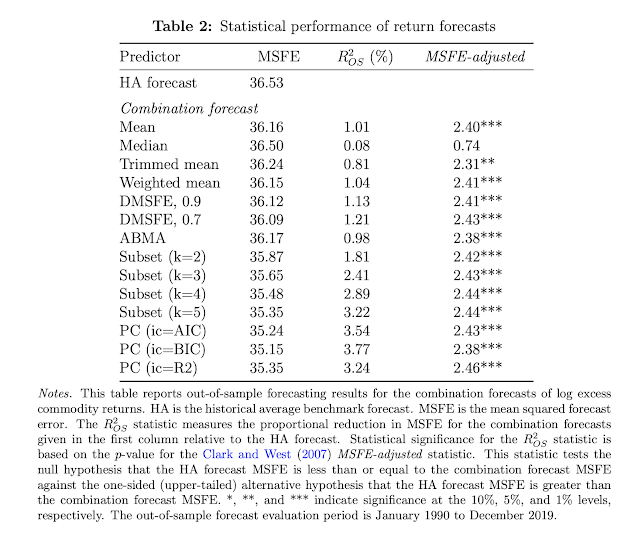

The authors form combination forecast of 28 potential predictors that add to Sharpe ratios across a broad set of commodity markets. Several combination methodologies are used with the predictors to form a forecast for future economic activity which is then combined in a regression with the market risk factor. The combination approach allows for a better representation for what future economic activity will be than single predictor or a regression with multiple predictors. This makes for a complex set results, but the overall conclusions are consistent with other work on this topic.

Tell me something about the real economic and I can tell you something about commodity excess returns. The study focuses on two-factor models which combines the market factors with innovations from the real economic combination forecasts. The work is consistent with the expectations from an inter-temporal asset pricing model (ICAPM). Given the focus on ICAPM, the models include factors that would also be associated with other asset classes. As with other studies conducted on predictions of commodity excess returns, macroeconomics variables and risks are key determinant for commodity returns forecasting. Of course, the R-squared for these forecasts are very low, under 5 percent, but the values are still economically meaningful.

What this work suggests is that even some simple macro adjustments to a commodity return model will provide value-added that is greater than just using past excess returns.

No comments:

Post a Comment