When an investment theme makes a cover on a business magazine, watch out. It usually means that the opposite will happen. Right now, the drawdown in bonds is worse than the drawdown of stocks during the GFC. Times are different, but it is worth internalizing how bad the bond market is. Investors may not fully realize this because their bond duration is likely less than the long bond, nevertheless, it has been a bad bond environment.

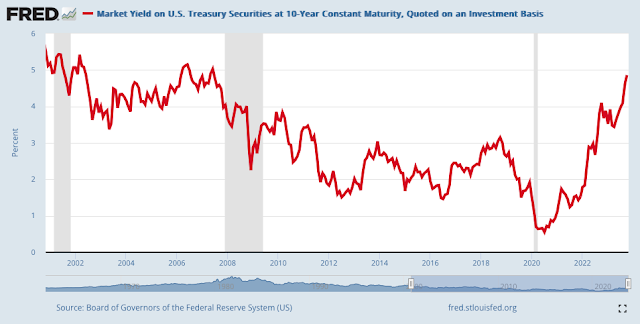

Rates are back up to pre 2008 levels and in the mid-2000's range. The rate increases from less than 1 percent to current levels just below 5% is unprecedented. Should we expect a reversal? To really get a reversal we will need a recession, further declines in recession and monetary easing. If that happens, we will have problems with risky assets.

No comments:

Post a Comment