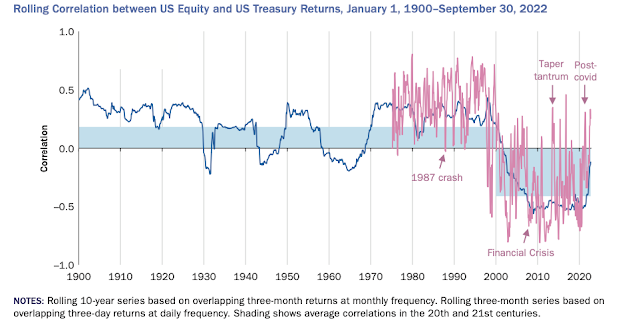

The one issue that has been vexing portfolio managers for years is the correlation between stocks and bonds. Is it positive or negative? if it is negative, bonds serve as a great diversifier even if rates are low. If it is positive, portfolio risk increases and their case for the 60/40 stock-bond mix is called into question. Investors need to know the drivers of this relationship. A recent AQR paper, "A Changing Stock-Bond Correlation: Drivers and Implications" provides more light on this situation.

The negative correlation of this century is not the norm, so the key question is whether the last 20+ years will continue. Of course, the relationship. has not always been negative in the short-run. Clearly, this correlation is based on macro drivers like growth and inflation which show the distinction between stock and bonds.

The key drivers for prediction the stock-bond correlation are growth risk, inflation risk, and growth-inflation correlation. There is a negative relationship with growth volatility, a positive relationship with inflation volatility, and a negative relation between with the growth-inflation correlation. While the stock-bond correlation is expected to rise, the overall direction for the next year is not clear given the changing volatility for growth and inflation.

No comments:

Post a Comment