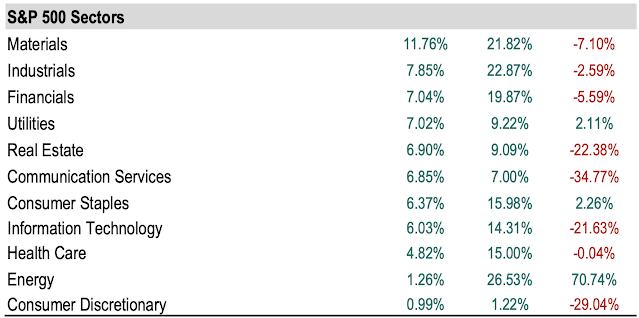

The major S&P 500 sectors showed high dispersion in November with a difference of over 12% between the best and worst sector for column 1. The year-to-date difference is over 35% even after we take out the huge 70% gain in energy in column 3. Real estate and consumer discretionary have suffered from the rise in interest rates, but communication services and IT are both much lower than the overall index return of down 13%.

The rotation of sector can be marginal when markets are stable and in a specific business cycle regime; however, regime transitions significant opportunities for gain and loss. Regime analysis is critical during transitions.

No comments:

Post a Comment