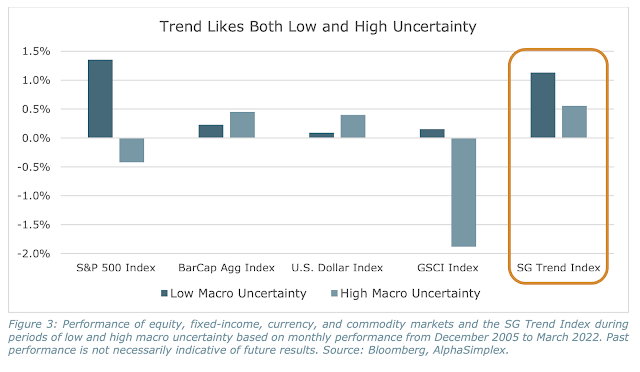

While trend-following does well over long-term horizons, there are periods or regimes when it will do better and worse than other asset classes. The regime focus has often been on the crisis alpha or the period when equities decline, but those periods are relatively infrequent and hard to predict. Another regime breakdown could be based on uncertainty as measured by the volatility across asset classes. An interesting research piece finds that trend-following does well in low and high macro uncertainty. See "Managed Futures and Macro Uncertainty: Navigating the Extremes".

There is an ebb and flow with macro asset class volatility that is measurable. The SG trend index does well in both low and high uncertainty environments. It is the middle range that is a problem.

Think of trend-following as a signal to noise problem. Trend-followers will make money when the signal from trends is high relative to the volatility of the markets. In a low volatility environment, a given trend signal will be strong all else equal. In a high volatility regime, the signal to noise falls, but it is generally found that trends are more likely in a high uncertainty environment. Investors become more cautious with their decisions and delay action. Hence, there can be good trend returns in a high uncertainty period. The slower to react investor story can explain why trends may do well in rising uncertainty and do less well in falling uncertainty environments.

Think about the environment to make judgments on trend performance.

No comments:

Post a Comment