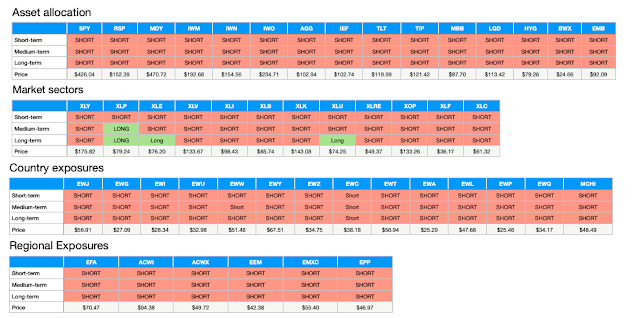

The worst-case problem for the diversified stock bond portfolio currently exists. Stocks and fixed income are both trending lower. Using our trend tracking system, I follow a key set of ETFs across asset classes, styles, and regions. The trend models are signaling the same thing for short, medium, and long-term trends - be short equities and bonds.

For the asset allocation set of ETFs, all are giving short signals. The global regional exposures are also showing short signals for all timeframes. The same is seen for country exposures. There are only long-term long signals for selected market sectors, such as consumer stables, energy, and utilities.

If you cannot get short, the only alternative is to hold cash and reduce beta or duration exposure.

No comments:

Post a Comment