The Fed QT plan is measured and cautious; however, the last QT program only occurred well after the beginning of the Fed rate hikes. Now, we are having the beginning of the rate hikes and QT occurring within 3 months of each other. The plan is an initial roll-off of Treasuries and mortgages with a ramp-up in September when the cap for reductions will be $90 billion.

Past evidence suggests higher volatility in bond markets like what we are seeing now, but that was associated with poorer forward guidance from the Fed, and we have more inflation risk. Currently, the announcement of the QT plan has been linked with the equity and bond selloffs, yet correlation is not causality when there really is no sample of past action.

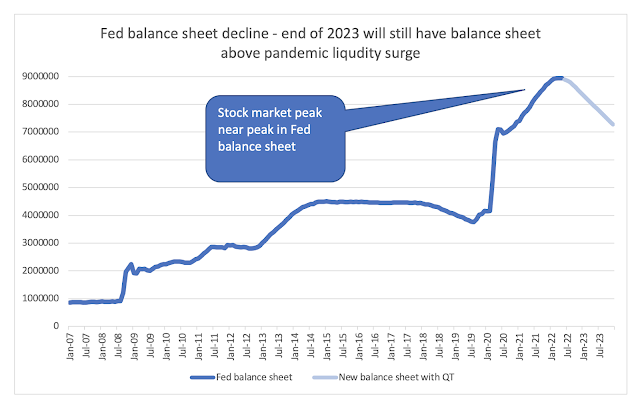

The decline in the Fed balance sheet through 2023 will only take levels back to the summer of 2020 and will not reverse any of the initial pandemic stimulus, so there should be limited reason to expect a strong bond sell-off from the decline. Additionally, given fiscal policy has slowed, the demands for the Treasury to raise funds will not be as strong as in 2020-21. Finally, the bond sell-off has started to make current US Treasury yields attractive to investors. The question is always what the incremental pressure on yields will be. Can the bond market take a reduction? At this point, there are other more pressing risks for bonds.

No comments:

Post a Comment