Trend-following will add value versus a buy and hold strategy. The evidence is very clear. This simple strategy has proven to be valuable during the current market environment. Michael Gayed in his paper "Leverage for the Long Run" provides some useful nuanced information for adding to returns and reducing risk based on the simple relationship concerning volatility of a stock index above and below the trend.

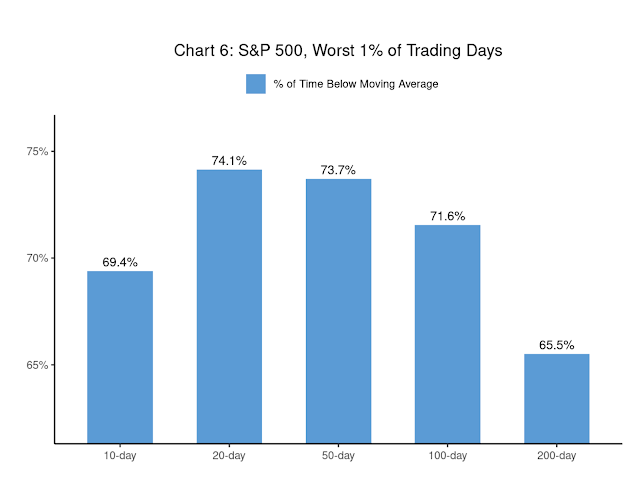

He finds that volatility is lower (higher) when the stock index is above (below) its long-term trend.

This information can be used to enhance an active strategy. Simply put, leverage when above the long-term moving average. You can take advantage of the overall lower volatility during these periods. During periods when prices are below the long-term moving average cut leverage by going to cash. The portfolio will be under-levered when volatility is high (below trend) and over-levered when volatility is low (above trend). The combination may be set at the same volatility as a buy and hold strategy but there will be improved return and Sharpe ratio.

Many trend-followers will trade the same leverage on their long and short positions; however, based on the strategy objective and market characteristics it can improve return to risk through accounting for volatility during periods above and below trend.

No comments:

Post a Comment