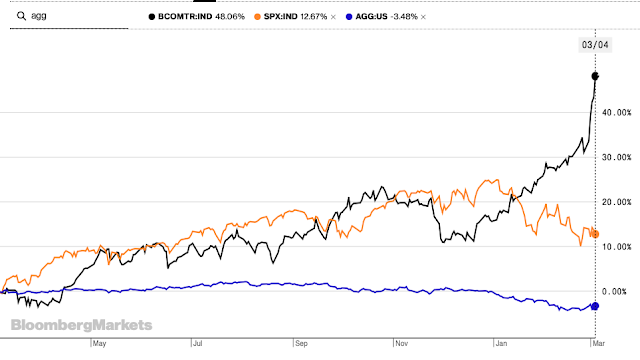

Our localized focus has been on the impact of commodity prices on the US economy. The move for the key Bloomberg commodity index has been over 45% in the last year and over 25% in 2022. It has not been limited to oil markets. Russia provides a significant portion of world supply of palladium and nickel, but the real export war story is with all the countries that may be dependent on Ukraine and Russia corn and wheat imports.

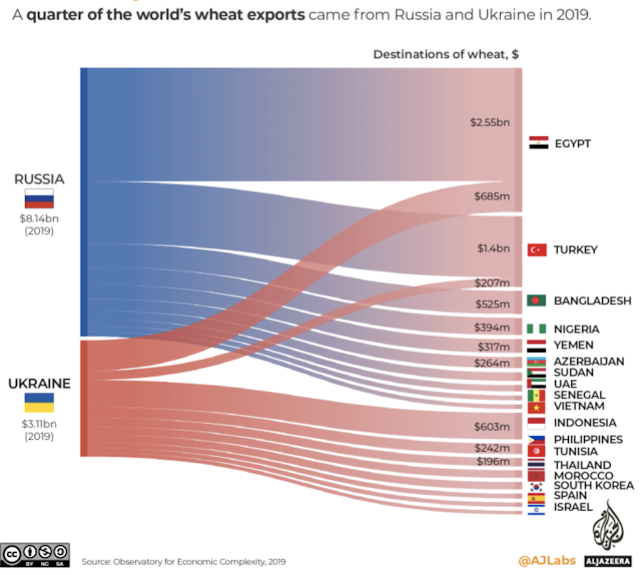

Wheat prices are up 40% this year. Russia and Ukraine represent 29% of the wheat export market. Stocks for major wheat exporters are at nine-year lows, enough to feed the world for only 27 days according to IGC (international Grain Council) data.

The chart below shows where Russia and Ukraine wheat exports go and show where they are in the wheat export rankings. For Ukraine, grain exports dominate their trade while oil dominates Russian exports.

No comments:

Post a Comment