“I’ve been doing this for 30 years and I’ve never seen markets like this. This is a molecule crisis. We’re out of everything, I don’t care if it’s oil, gas, coal, copper, aluminum, you name it we’re out of it." - Jeff Currie Goldman Sachs commodity analysts

These markets can be described as super-backwardated with textbook shortages. If you cannot get inventory or believe there is a threat to your normal levels, you will pay a premium for convenience - the convenience yield with current prices higher that back month futures. There is no normal carry with these markets in the front month futures.

We have referred to this as the switch from just-in-time to just-in-case inventory management. (See "From just-in-time to just-in-case commodity markets") It makes even more sense if price trends are going higher - a positive feedback loop. Hold inventory based on the threat of stock-outs and receive a gain from higher trends.

The cost of holding inventory is also insanely cheap if there are negative real interest rates. I don't want to use the word hoarding, but everyone who needs commodities want to stockpile in this environment which is one of the problems in an inflationary world - expectation start to adapt to a new environment.

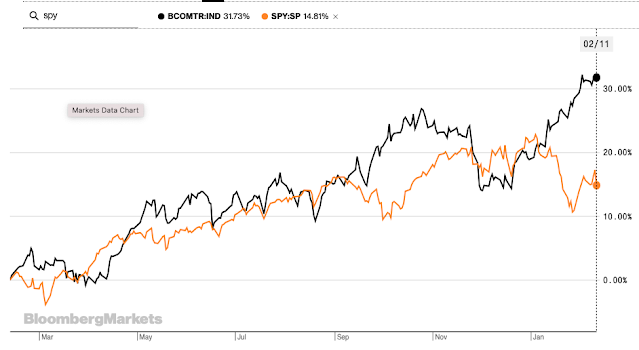

Note that the commodities have underperformed over the last five years. The stockpiling mentality has taken hold in the last year. The upward trend accelerated with the surprise increases in inflation. Geopolitical uncertainty associated with Russia has only added to the stockpiling mentality.

These price increases are not likely going away in the current macro environment. Real rates are at extremes and a set of 25 bps Fed increases is not going to change this environment. While China is not on the same high growth path of the last two years, it is being offset with the potential for better growth in the rest of the world. Of course, this is more of a hope than reality given the declining growth estimates of the IMF last month (4.4% from 4.9% for global growth).

A greater long-term problem is the capital expenditures in extractive industries. These are not good industries in an ESG world. Traditional agriculture is also on the list of less ESG friendly investing. Commodity super-cycles are based on less capital expenditures in key commodity sectors.

No comments:

Post a Comment