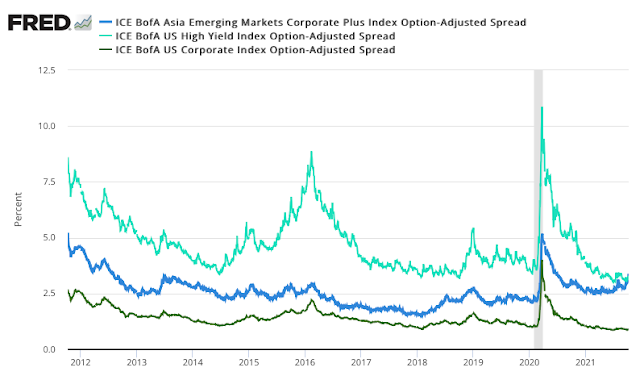

Changes in corporate bond flows will impact any investor looking at global fixed income opportunities. For the first time since 1998, the Asian emerging markets investment grade OAS index has exceeded the US high yield OAS index. The investment grade Asia - US OAS index spread difference is widening. This is the Evergrande, Chinese property developer, effect weighing down the Asian bond markets. As more developers delay payments, this spread will get worse.

Earlier widening last year occurred when US spreads dropped faster than Asian spreads because of Fed policy action. This widening is occurring because of high-risk perception in Asia. US high yield is rising slightly but investment grade has been stable. The essential fixed income question is whether there will be a spill-over to higher quality credits in the US and Europe. There is no fundamental reason to believe this, but contagion can change everything.

No comments:

Post a Comment