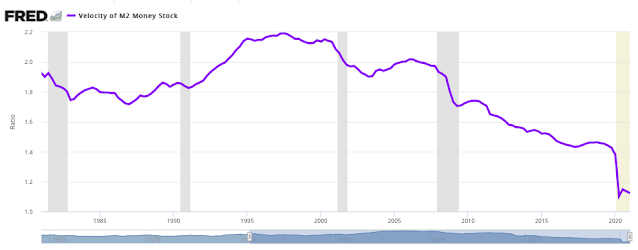

P-star is a simple toy model. Take the classic quantity theory of money equation, MV=PT and include money growth, long-term trend in velocity, and long-term NGDP growth to solve for inflation potential. P-star = M(V*)/NGDP*.

P-star is the price inflation that would exist given current money growth and if velocity and GDP were at their long-term trend. It is then easy to compute the gap between P-star and P. This gap would be the expected inflation given trend velocity and GDP versus actual inflation. This inflation gap can be closed a number of ways; however, if money growth stays high and velocity and growth normalize to trend, the only solution is an increase in actual inflation.

There will be a delay effect between a money shock and economic trend, but the logic is straightforward. If excess money balances are drawn down, velocity which has been excessive low will increase and move back to long-term trend velocity. GDP may rise above trend, but if it reaches potential GDP, prices will have to rise. If GDP growth is constrained by its potential, then higher money will need to be held as higher balances which will lower velocity or prices will have to rise to equilibrate our classic equation.

There are a number of simplifying assumptions with this toy model, but it provides a point of departure for discussion using a simple monetary framework. If growth is below potential, there is less likelihood that prices will rise. If money balances are high (velocity is low), there is less inflation, but if balances are reduced and spent, prices will rise especially if GDP is constrained. Output gaps which are closed will also close inflation gaps.

Of course, this does not account for leakages into the financial system which have been high and have served as an alternative to purchases of goods and services. Money balances may decline not to buy good but to purchase financial assets. The financial leakages have driven financial prices not real assets. It is assumed that as the economy normalizes, financial leakages will switch to real purchases.

No comments:

Post a Comment