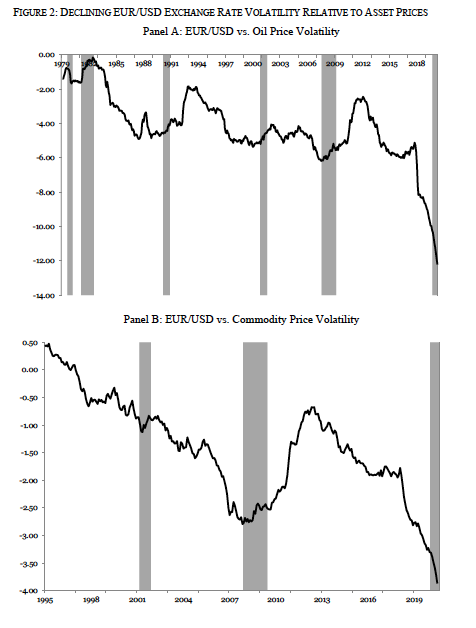

A recurring hedge fund theme is that global macro investing is dead or at least much harder in the last decade. Who could be surprised with this assessment given there is no volatility in many major markets? For example, look at currency markets. They have been on a decline since the early 1980's. The volatility fall has only accelerated since the Great Financial Crisis. This fall has been on both an absolute and relative basis versus other asset classes such as commodities and equities. For a full report on currency volatility trends see the Brookings Institute draft paper, "Will the Secular Decline in Exchange Rate and

Inflation Volatility Survive COVID-19?"

So, what is the cause of this long decline in currency volatility? Inflation across most countries has declined significantly with the standard deviation and median annual inflation well below the average for the post-WWII period and is even low for the post-GFC period. This decline is well below the period known as the Great Moderation. Nominal and real yields are also low and show limited dispersion by historical standards.

There is every reason to believe that this low volatility currency environment will continue. Rates across advanced economies are all expected to stay low. The Fed has used its power to provide currency swaps to stabilize the dollar. Fiscal policy is being used to stabilize economic growth around the world. Currencies, as a relative price, are stabilized given the underlying economic drivers are stable.

The question for 2021 is whether a stable global environment will continue or whether economic dispersion will return in growth, inflation, and rates. The consensus is on continued calm; however, when volatility is so low, the cost of betting on increased volatility is cheap. Minsky moments can occur in the global macro arena.

People who haven't read Minsky tend to misunderstand Minsky. Minsky's main idea was that volatility (Minsky moments) were a product of LAISSEZ-FAIRE capitalism that could, and should, be avoided by government intervention. His desire was to use government policy to suppress the business cycle and thereby avoid what came to be called Minsky moments. Governments agreed with Minsky and have implemented his proposed remedies - massive fiscal and monetary interventions to eliminate the business cycle. We could see volatility, but that volatility won't be a Minsky moment - it won't be the product of laissez-faire capitalism.

ReplyDelete