"Trends last longer than expected"

"The success of any trend sows the seeds for its own destruction"

Two very different views of the world, yet both can be true. Trends will often last longer than expected and most trend-followers will make most of their annual profits on a few major dislocations. All trends will also end and as markets move to an extreme, there is will be some reversal. It is one of the reasons why stop-loss and risk management is so critical for trend-following success.

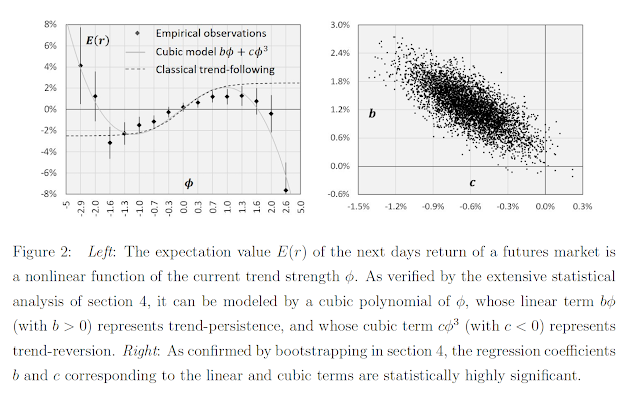

A recent paper, "Trends, Reversion, and Critical Phenomena in Financial Markets" by Christof Schmidhuber, looks at the behavior of prices across a broad set of 24 markets in four major asset classes. He forecasts the next day's price based on the trend strength across different look-back periods. The next day's price will increase with the measured strength of a trend until there is a maximum at which point there is greater likelihood of a price reversal.

He finds that a cubic polynomial may describe trends at different lengths. There is a linear trend component and a second component that represents the non-linear mean reversion in prices. This trend structure exists across all markets and asset classes; however, the trend/reversal structure will differ based on the length of the look-back period. The best time scales are between 3 months and a year which are consistent with the look-back periods for most trend-followers.

As trends get stronger, there is an increased likelihood of mean reversion. This is not an easy paper to understand on a first reading, but the results are compelling. If the trend is statistically significant and thus likely obvious to most, it is time to get out. The approach driving this analysis is novel and provides some good insight for all those following trends.

The success of trend traders may have more to do with learning how to exit and beat the mean reversion. At a simple level exits can be driven by trailing stops. If markets pullback by a set amount, exit. At a more complex level, the exit could be driven by a specific model of mean reversion or market extremes. The exit process is a value-add for the active trend-follower.

Some may find the results in this paper surprising, others obvious, but the most important point is that looking for trends alone may not be good enough to be successful. You can follow trends but realize there will always be a time for reversal.

The term "mean reversion" is not used in Schmidhuber's paper. You're using that terminology incorrectly. Mean reversion applies only to random samples taken from a known, completed population. It does not apply to prices, which are a population to which new elements are being added every moment of every day. The mean of a population that is constantly growing can't be known, so there can be no concept of reversion to the mean for prices. Reversion to the mean, as a statistical concept, does not refer to "reversion to the mean so far."

ReplyDelete