The Invesco Global Factor Investing Study 2019 shows further increases in factor investing alongside active and passive strategies. Factors are not being used just to monitor risk, but to increase returns. Investors are making market beta decisions but also factor decisions like carry, value, and momentum. Managers are also not just investing in factor exposures but making tactical trading decisions on which factors make sense at any given time.

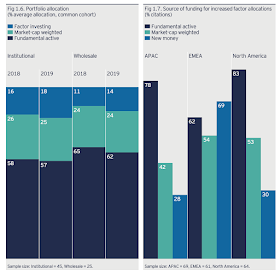

Factor investing is not as large as fundamental active or market weighted investing, but the allocations are meaningful. Investors are dropping their fundamentally active exposures to hold these factor exposures. Investors are making active timing choices between value, carry, and momentum and not just passively making allocations to core factor strategies.

There are still challenges for investors who use factor strategies, but the need is not education but analysis on timing. The greatest challenges are determining when to add or subtract a factor, forming return expectations, and monitoring the risk from factor exposures.

Investors are accepting the scheme that asset returns can be decomposed into factors which can be exploited directly. The challenge is not determining whether to decide on factor exposures but how to make adjustment in exposures and determining when to change exposures. Factors are time varying and investors want to exploit factor opportunities no different than buying (selling) cheap (rich) assets.

No comments:

Post a Comment