The value of investing in risk premia is well-know. They have positive expected return over long time periods and have low correlation between styles and asset class as well as with the market portfolio. There is significant potential value from forming portfolios of different risk premia styles and asset classes. The measurement of risk premia returns and correlation were reviewed in our recent post, A Century of Factor Premia and Timing Evidence - What you need to know - Part I.

Recent research has also focused on whether these time varying risk premia can be forecast. The results on forecasting risk premia are mixed. The extensive research conducted by AQR Capital on risk premia in their long paper suggests that timing will be difficult and that a simple diversified risk premia portfolio may provide an easier way to obtain an effective return to risk combination. (See "Factor Premia and Factor Timing: A Century of Evidence")

The "century of evidence" paper details and studies a significant number of forecast choices. For example, a simple specification, derived from the data, is to look at the value spread as a timing model. This model can be applied to all styles and asset classes. What is clear from their testing is that the value spread as a timing model has spotty performance. While it works for some asset classes and styles, there is no pattern strong enough to state that this type of timing model will lead to significant success. Nonetheless, a value spread model applied to multi-factors for all asset classes shows some value-added.

The researchers also look at a wide combination of models to test timing. There is some marginal value or alpha production from timing but no one approach dominates the timing choices.

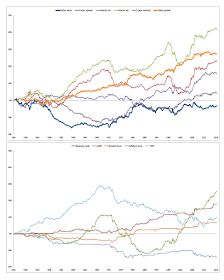

A time series of returns using these timing strategies illustrates the point better. Some timing models fail completely while others show mixed performance between positive gains and failure like the value spread and inverse volatility. When a full model of timing variables is applied there is positive returns, but it will come at a cost and generates limited alpha.

Recent research has also focused on whether these time varying risk premia can be forecast. The results on forecasting risk premia are mixed. The extensive research conducted by AQR Capital on risk premia in their long paper suggests that timing will be difficult and that a simple diversified risk premia portfolio may provide an easier way to obtain an effective return to risk combination. (See "Factor Premia and Factor Timing: A Century of Evidence")

The "century of evidence" paper details and studies a significant number of forecast choices. For example, a simple specification, derived from the data, is to look at the value spread as a timing model. This model can be applied to all styles and asset classes. What is clear from their testing is that the value spread as a timing model has spotty performance. While it works for some asset classes and styles, there is no pattern strong enough to state that this type of timing model will lead to significant success. Nonetheless, a value spread model applied to multi-factors for all asset classes shows some value-added.

The researchers also look at a wide combination of models to test timing. There is some marginal value or alpha production from timing but no one approach dominates the timing choices.

A time series of returns using these timing strategies illustrates the point better. Some timing models fail completely while others show mixed performance between positive gains and failure like the value spread and inverse volatility. When a full model of timing variables is applied there is positive returns, but it will come at a cost and generates limited alpha.

The table below shows the increased Sharpe ratio for different timing models versus a static portfolio of no timing. The table also shows how much weight should be given to a timing model. Looking out of sample, it is not clear that the timing models can significantly boost performance as measured by improved Sharpe ratio.

The results from this timing work may be disappointing but should not be surprising. Timing market betas is not easy. Markets are generally efficient. The relationships with macro variables are also likely to be time varying. Hence, any conclusions on market timing especially when testing out of sample are likely to show, at best, mixed results.

The same efficiency prior should apply to trying to time risk premia. Risk premia portfolio construction should focus on broad diversification and any timing decision beyond adjustments for volatility and correlation should be done with care.

The same efficiency prior should apply to trying to time risk premia. Risk premia portfolio construction should focus on broad diversification and any timing decision beyond adjustments for volatility and correlation should be done with care.

No comments:

Post a Comment