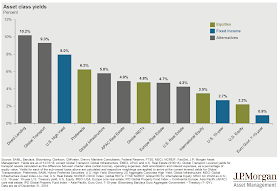

The attraction to private equity and other less liquid alternatives is clear from the Guide to Alternatives by JP Morgan Asset Management. The return profile is much higher for private equity and debt funds than more liquid alternatives and global bonds; however, the dispersion in returns is multiples higher than what can be expected from other public categories.

If you don't pick your funds correctly, you could be greatly disappointed and you will not likely be able to exit from your mistakes. The large dispersion suggests that skill is differentiable, so the effort at trying to find the right manager will be more likely rewarded. On average, there is some illiquidity premia with these alternatives; however, there are no guarantees that the average illiquid fund will do well as evidenced by the venture capital sector.

Within the alternative space, direction lending has been the key winner for yield as non-bank institutions have intermediated the debt markets. The yield difference between equities and alternatives is much tighter when comparing real estate choices.

The big investment question is whether the higher returns with private equities will continue at this point in the business cycle. A comparison between public and private equity returns suggests that the best days for private equity may have already occurred based on the return differentials between private and public funds.

No comments:

Post a Comment