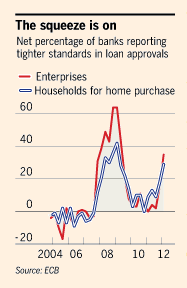

Sometimes there is too much focus on inflation targeting and money growth and not enough on the credit transmission methods. There is a credit crunch in Europe and the ECB has to deal with it. Regulators are going to have to deal with it. ECB lending facilities is a first step but more is going to be required.

Credit standards are tightening not loosening. Corporate lending is negative. This will have ramifications around the globe because of the long reach of EU banks. Banks will usually cut global lending first and start to have a home bias. It is this lending constraint problem that will put pressure on emerging and commodity markets.

No comments:

Post a Comment