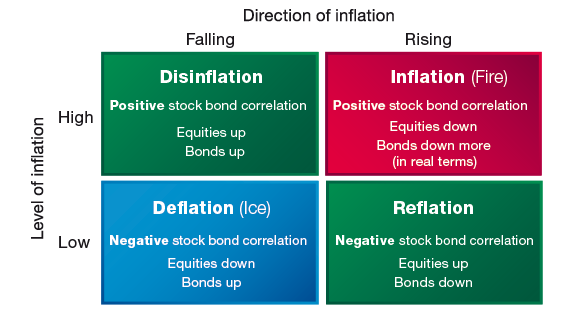

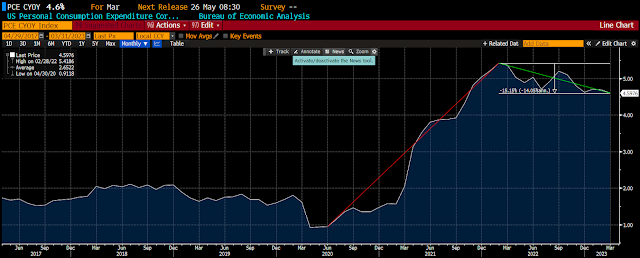

With the PCE core inflation showing sticky behavior at 4.6% YOY, the promise of lower inflation may not be as strong as suggested even two months ago. Investors must ask where they are positioned within the inflation matrix and where may the market be in six months. This will provide answers to the correlation environment and what will be the diversification expected between the two major asset classes.

"Disciplined Systematic Global Macro Views" focuses on current economic and finance issues, changes in market structure and the hedge fund industry as well as how to be a better decision-maker in the global macro investment space.

Sunday, April 30, 2023

Inflation and the stock-bond correlation relationship - the driver for asset allocation

Saturday, April 29, 2023

Inflation is not going away - So what do investors need to think about?

The core PCE YoY is falling, and the trend is lower, but the speed of the decline in not as fast as expected by many economists and investors. This number suggests that the Fed will still have to raise rates. A recession and falling prices are still expected at the end of the year, but investors still need to focus on balancing their inflation/deflation strategy.

The focus must still be on balancing strategies to account for inflation and hold exposure to dynamic strategies like trend-following, global macro, and commodities. Strategy diversification is still critical because the inflation story does not seem to be ending. While from an older piece of research from AQR, the story is the same, diversify. See Fire and Ice: Confronting the Twin Perils of Inflation and Deflation.

A surprise decline in inflation will be good for both stocks and bonds but a surprise increase will be negative for both main traditional asset classes. Commodities will give you protection if we have more inflation, but the decline in a falling inflation environment will be severe. Trend and macro momentum are two places where there is protection from either upside or downside inflation surprises. Given the amount of uncertainty, it is not too late to consider either strategy to reduce downside risk. The current gains in equities and bonds offer investors a chance to rebalance and prepare for any next move in inflation.

Short-term and long-term strategy skew

The skew of an investment strategy will change with the investment time horizon that you use. An interesting research piece from the folks at Quantica, the managed futures manager discusses the poor performance for many CTA during March. No trend-following manager was immune to the market reversal risk last month, but they also reported a more interesting nugget of information for investors.

Quantica looked at the strategy skew for different time horizons from one day to 250. They found that trend-following has a strong negative skew in the short-run but then moves higher to a strong positive number which peaks at about the six-month mark.

Trend-following, the capturing of market behavior that is moving higher or lower based on price behavior, will generate positive skew in the longer-run; however, over the short run, returns will be hurt by market reversals which may create negative skew. Long-only global equities will have strong negative skew in the short-run that will also improve, but the profile will stay negative regardless of the investment horizon.

There is pain when looking at the distribution of a trend strategy over a day, week, or month, but investors will be rewarded by sticking with the investment and allowing the cumulative price trends to take their course. Holding onto winner and selling losers will create positive skew, but regardless of the risk management, the chop and short-term reversal seen with trending markets over short horizons will cause a different skew profile.

Reread "The Bankers' New Clothes" - Still a fresh look at banking

It is 10 years since The Bankers' New Clothes was written by two of the best bank finance professors. It was supposed to explain the risks with banks and what we can do to diminish the risk to the economy and the government, taxpayers, who provide an insurance backstop. We wrote about it in What is it about bankers' clothes? The argument of Admati and Hellwig its simple, banks need more capital and less leverage. Banks are not special relative to any other firm that uses leverage to boost profits. If banks make bad investments with leverage, the pain is real. We can talk about risk management and supervision but the best and first line of defense should be more equity in the business.

Look at all the bank failures this year. The problem is the same as any in the past. More investments that turn unprofitable and blow through all the equity. The threat of losing equity makes any lender or depositor want to exit. Increase equity the downside risk is limited. Of course, greater equity will impact lending and bank decision making, that may end up being a good thing for the economy. This does not change the original sin of zero interest rates for over decade; however, the responsibility of managing assets still rests with the bankers.

Thursday, April 27, 2023

The meritocracy must be tempered with empathy

Adrian Wooldridge's provocative book, The Aristocracy of Talent: How Meritocracy Made the Modern World tells the interesting story of how the world moved from a system of privilege to one based on merit. We often forget that even less than 100 years ago your success was measured by your station and not your talent.

The world adaptation to a merit-based system has been a boom for productivity, economic advancement, and success. Your success was not based on your name but on your actions. Think of all who were talented but denied access to economic opportunities. A system based on intelligence and skill created a unique ladder for many to climb.

We would not be as successful as a world without the focus on merit, yet the meritocracy system may have reached an extreme that has a dark side. A merit system focused on the wrong measures can lead to a new ruling elite based on credential that serve as new barriers to entry. IQ and other aptitude tests have created a barrier to entry. A world based on merit test scores can misallocate resources to score taking and not innovation or hard work. A world sorted between merit haves and have not can also be restrictive. Hence, a world based on "talent" may be subject to problems seen in history that stifles creativity and innovation. A meritocracy is subject to corruption no different than other systems of privilege.

So how do we find a happy medium between merit, equity, and equality? The solution may be through redefining and rethinking merit with a movement away from one single measure of talent. Merit is not a test or a ticket from a school, but a broader measure based on hard work with a sense of empathy and equity for others.

Sunday, April 23, 2023

Does the macro-announcement premium exist?

There has been found a macro-announcement premium associated with equity markets. There are high returns on announcement days relative to all other days which suggests that there is a risk premium associated with these special news days, yet a close look finds that the conditional return volatility does not drop after announcements. This stability with volatility is odd given the concept of an announcement risk premium.

A new paper "Is There a Macro-announcement Premium?" funds that the average announcement return is associated with monetary policy surprises and small-sample problem. The announcement effect does not really exist for employment and inflation days. After monetary announcements and sampling are accounted for, there is little macro announcement premium.

This is very useful research since it answers some of the questions surrounding this announcement premium effect that has been found by other researchers. First, a careful review of the announcements shows the focus is on monetary announcements and not on other key announcements. Second, if we account for the sample of announcements, there is a significant change in the results. Overall, there is not a strong premium associated with macro-announcements.

Saturday, April 22, 2023

Old school Chicago machine politics

The Council dean, Alderman Ed Burke, closed his last Chicago city council assembly by repeating one of his favorite quotes: “In politics, there are no permanent enemies and no permanent friends. Only permanent interests.”

The quote is an interesting commentary on old school Chicago politics. Ed Burke served as alderman in Chicago City Council from 1969 through 2022, and is charged with corruption and will go to trial in November 2023. He was well known for his Chicago power politics.

Tuesday, April 18, 2023

Macro sensitivities can be found in equity portfolios

There has been an explosion of research work on factor risks within equity portfolios. The go to analysis is to describe a portfolio through factor exposures like momentum, size, quality, value, or volatility to name a few; however, a key driver is still macroeconomic factors. A recent paper "Targeting Macroeconomic Exposures in Equity Portfolios: A Firm-Level Measurement Approach for Out-of-Sample Robustness" provides useful insights on macro risks that are different than factor premium and have out-of-sample robustness.

Macroeconomic risks have a real effect on portfolio returns and can be picked up through cross sectional exposures that are sensitive to these macro exposures. While most macro exposures are gained through differences in asset class allocations, equity specific portfolio exposures can also create macro risk exposures.

These macro exposures can be obtained through focusing on market-based proxies for macro risks which can be obtained daily and are based on the aggregate behavior of investors. The authors look at short rates, the term premium, the credit premium, and inflation breakevens as good forward estimates of key macro risks. Rates provide information on monetary policy and economic growth. The term premium is viewed as an important indicator on future growth. The credit premium provides insights on growth, and inflation breakevens tell us something about future inflation. The change in these variables can serve as a surprise estimate of expectations.

These macro portfolios can be formed to be either positively or negatively sensitive to macro surprises.

Finding scalability - The key to implementing ideas into practice

John List's The Voltage Effect: How to Make Good Ideas Great and Great Ideas Scale is another good book on the practical application of microeconomics. The powerful title on a voltage effect is just a way to introduce the key concept of scalability. Every business firm wants to gain economies of scale, but the concept can also be applied to any idea as well to production practices. Scaling of ideas is much harder than most people think. Marginal benefits often decline. For List, gaining scalability is the voltage effect.

List describes how much of human behavior is not scalable. What makes sense and works with a small group does not often work when applied to larger groups or is attempted to be replicated. This problem goes back to the fundamental issue that incentives matter. If you focus on the wrong incentives, most projects will not scale. The book focuses on many fundamental microeconomic issues:

- Any research work especially with field experiments is subject to false positives.

- Know the subject audience and whether your subjects drive the results.

- Is the desired effect driven by the chef or the ingredients employed.

- Are there spillover effects, the problem of externalities.

- What are the costs of gaining scale and when do you quit.

Microeconomics has been viewed by many as a dry subject, but List turns the dismal science into a tool for extracting unique answers to complex problems. The challenge for all who want to find scalable answers is to do conduct good experiments in a complex world that is not within a laboratory.

As said on the first page -

"Scalable ideas are all alike;

every unscalable idea is unscalable in its own way."

Saturday, April 15, 2023

China - US relationship founded on false narratives?

Stephen Roach is a long-time Wall Street economist who was the chairman of Morgan Stanley Asia for several years and a current fellow at Yale University. He has been commented on China-US relations for decades through his varied experiences. His new book, Accidental Conflict: America, China, and the Clash of False Narratives, is an attempt to address the key problem of how to get the two major powers of the world to candidly talk with each other in a construction manner.

Roach covers ground that many have already explored. There is a shared history. There is a strong codependency with China having high excess savings and the US engaged in excessive spending. The savings imbalance links both countries in a close relationship whether anyone likes it. The savings imbalance story is hard for policymakers to understand. Setting up tariffs and trade constraints is not going to solve the problem. Micro solutions to macro problems are providing the wrong first aid for chronic problems. This applies to both the US and China. China needs to reduce savings and become more consumer focused. The US needs to increase savings and investment.

The US has a false narrative about China motivations and actions which are often economically rational, and the China has false narratives that are generated to maintain the current power structure within China. The extension of current narratives lead to conflict as each party responds to real and perceived falsehoods. Standing down through cooperation is an optimal solution yet is not the solution that most will choose. Game theory, while not explicitly discussed, provides us with a framework of how solutions can be found, yet the obvious solution is not always the first choice when politics are driven by rhetoric targeted to the average citizen of each country.

Roach provides detailed information on China and US relations and each reaction over the last few decades, but the overall story could have been condensed into a tighter presentation. I agree with his false narrative presentation, but I am afraid that this framework is simplistic and does not address the complexities of the competitive conflict that has arisen over the last two decades. We have expected that by having China enter the WTO, it would be ripe for change into a more democratic/ capitalist country. This was a false premise that is the crux of the current problem.

Can both countries move beyond the false narratives described by Roach? I am not optimistic. False narratives are hard to reverse because the falsehoods are often wrapped in some basic truths. China and the US are competitors, yet for the good of the world this competition must be tempered though finding a common ground of trust.

The Why Axis - It is all about finding the right incentives

Economics is often the study of incentives. People act based on the incentives faced. These actions can be often quantified in simple basic economic classes through a discussion of price demand, yet prices may not be the sole motivation. Human behavior is more complex, and economist have now determined that extracting the correct incentives and motivations is much harder than often thought. The book The Why Axis: Hidden Motives and the Undiscovered Economics of Everyday Life by Uri Gneezy and John List provides a very readable introduction to the current trends in microeconomics which focus on field work to measure incentives for behavior in regular behavior. The authors talk about their long-term research agenda to tease out incentives for practical problems that have important applications.

What has been a significant trend over the last two decades is a pivot to field work that sets up controlled experiments on what incents behavior, or what can be used to motivate behavior. How do we get donors to increase giving? How do we get students to learn? How do price products to increase sales? Gneezy and List find that what may seem like to obvious answer is not often correct. Motivations and incentives are complex and often need to be measured through careful experimentation between a test group and a control group.

This work becomes very interesting when tied to finance. What causes investors to buy and sell stocks? The simple answer is to make a return on investment, but what information or packaging of information works to cause investors to engage and act. I don't think we often know the answer. We see herding behavior. There are behavioral biases. Some news cause reactions while other news which may seem important later are greeted with a yawn. The motives of investors are still a mystery and require further deep study. The incentives for financial decisions is more than just saying that investors want to make money.

Thursday, April 13, 2023

Spearman versus Pearson correlation which is better?

Sunday, April 9, 2023

Decision Analysis to Solve Uncertainty Through Action Planning

Fed liquidity breaks the link between financial assets and economic risk

Friday, April 7, 2023

Risk Premia and Skew - Know your skew and embrace skew

Are you paid for skew or is skew the result of crowded high returns to risk? This is an interesting question for strategy selection and important for the risk premium narrative, yet it may be difficult to unpack.

The c factor and group effectiveness

Group dynamic can have significant value through the wisdom of crowds. A diverse group should reach better decisions and make better forecasts; however, it is also well-known that group dynamics can lead to herding and disfunction. Just because you place smart people in the same room does not mean that they are going to get better results. The interaction between groups members matters. There is name for this, the c factor, the collective intelligence of a group which is not the same as the individual intelligence of a group member.

Thinking about the c factor is a form of positive psychology that focuses on how groups can function efficiently instead of focusing on the level of disfunction. Similar to intelligence, the c factor is the ability of a group to perform a wide variety of tasks. Group skill is more relevant to group success than the average or maximum individual intelligence. There is such a thing as group intelligence which is not just a combination of individual skills. The group skill is tied to experiential knowledge. For example, has the group worked on similar problems or have familiarity with the problems?

Additionally, it has been found that three factors help with a high c factor, social sensitivity, gender composition, and equitable turn-taking. The social sensitivity can come in a few forms, but a good word may be empathy or a sense of understanding another person's point of view. Since social sensitivity is hard to measure, it has been found that a higher degree of gender differences will lead to more social sensitivity. The third factor is ensuring that there is not dominance by just a few members. The group benefits collapse when there is less cross communication or the allowance for everyone to speak and be heard.

An investment committee can work more effectively if there is more open communication, increased willingness to listen to other opinions, and bringing in more diversity. Yes, this may sound obvious, yet it is often hard in practice. Regardless of the investment firm, there will always be group dynamics even if it is in the form of research meetings; consequently, every firm should work on improving group dynamics and intelligence.

Thursday, April 6, 2023

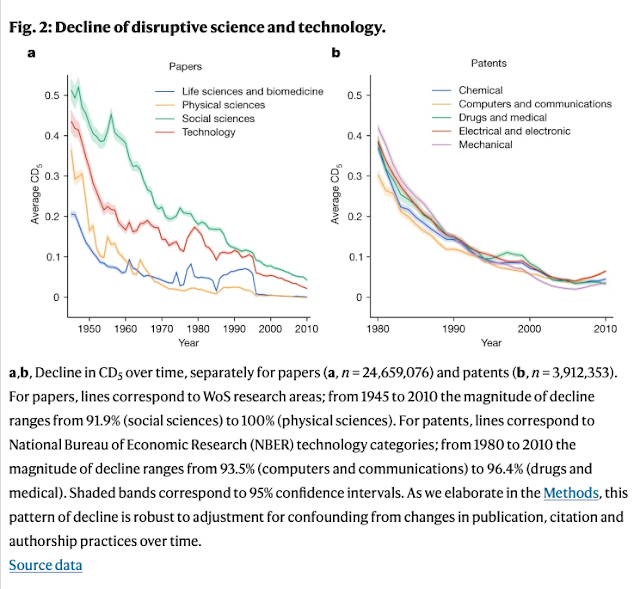

Science is now less disruptive

Economic growth is closely tied to productivity and productivity is linked to innovations in science. The link between scientific discovery and business innovation can take time and increases in productivity can be delayed for decades from the initial breakthrough, but discovery in science is necessary for this process of economic technological change to work. No new discoveries and there will be limited technological change. No new technology and productivity will not improve, and real incomes will not increase.

We are will not feel the effect of this slowdown immediately, but the cumulative effect of less disruptive research will start to weigh on productivity. The link may be weak, but the ramifications of less new science will impact all economies.

Monday, April 3, 2023

Manage coskewness and improve momentum trading

I am biased toward momentum trading whether cross-sectionally or as a time series. It is simple to implement and has been a consistent risk factor across long periods of time. Of course, it may fall out of favor over short periods, but it has generally produced strong returns over the long run. Unfortunately, a problem exists.

Momentum is subject to crashes and shows negative skew. Past returns winners show negative skew while past losers show less skew. The net result is that a winners minus losers portfolio will have negative skew. The gains from momentum are balanced against the pain from these periodic crashes. If only the negative skew problem could be solved, momentum would be an even better core strategy.

Crashes are more likely when volatility is high. Hence, if momentum portfolios are conditioned on volatility or more importantly coskew, there is the potential for improvement versus a momentum portfolio that is not adjusted for this factor. This issue is addressed in the paper, "Coskewness and Reversal of Momentum Returns: The US and International Evidence".

The authors find that coskew for stocks is important especially during less volatile periods. Momentum returns reverse during high volatility periods but not from coskew. Overall, if coskew rises (falls) above (below) a certain level, it makes sense to cut (increase) momentum exposure. This simple rule will reduce the change of a momentum crash and improve the overall return from holding winners minus loser momentum portfolios.

Sunday, April 2, 2023

H.4.1 data - Fed balance sheet and QT reversal

The global economy and China - A two-pronged issue - geopolitics and economics

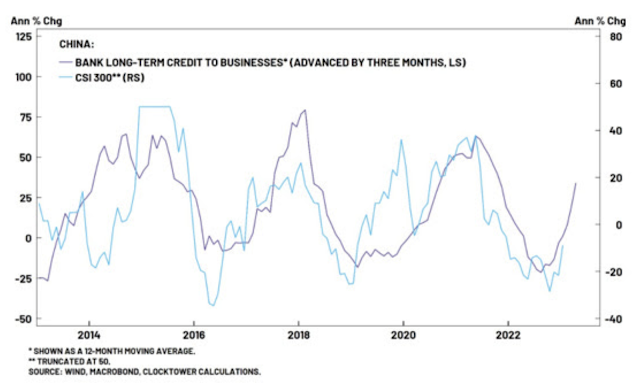

Investment and economic views concerning China are key to global market success in 2023 especially since there is the view that the US will likely be in a recession starting in the second half of the year.

There is a clear geopolitical risk based on the tensions with the US surrounding trade and Taiwan. This uncertainty slows long-term investment. Who will invest in fixed plant and equipment when the 5 to 10 year horizon is cloudy? This uncertainty only increases based on the unclear market and regulatory environment inside China.

The cloudiness is embedded in stock prices, yet there is a more positive investment message for the short-term. One, COVID restrictions have been lifted. The November rally is clear. Two, there has been an increase in credit available for investment through looser monetary policy. The PBOC is not following the western approach of monetary tightening. Three, the economic data are stronger as presented by the recent PMI especially for non-manufacturing spending. An increase in Chinese consumer spending can be a strong factor for global growth if there is an increase in imports.

The monetary policies of yesterday create the market structure failure of today

We will tolerate moral hazard, bailouts, lax supervision, and zombie firms to not address the bubble in financial assets. We don't want to pay the price for financial policy sins and allow for an economic morality play. To lay blame requires self-analysis and requires admitting to mistakes.

The more recent problem started with the mistake of economic shutdowns from COVID that were relieved through excessive monetary policy. Of course, we are not focusing on the large problems arising from excessive policy post the GFC. The public would not tolerate shutdown if they were not paid to accept these policy choices. The true problem arose when an immediate solution became a normal policy action which led to monetary excess. Now the Fed is trying to reverse the excesses. The Fed put that worked in a low inflation environment has now become a Fed focused on a market structure that does not allow failure.

The Fed valued labor over inflation to the point that it now needs to raise rates and reverse the excess. The result is no Fed put for financial markets, but a selective support of institutions based on politics and sentiment. In the case of SVB, the bailout was not for any banking institution but for the politically powerful venture industry. The Fed and government are using selective support to stop the natural result from the reversal of the monetary and fiscal policy bubble.

The current policies create a large transfer from bond holders to creditors through a combination of stronger growth, higher inflation, and the repricing of bond risk. US marketable debt to GDP has fallen from highs. We are living through a new period of financial repression where inflation exceeds the interest rates and wealth is taken from savers and lenders and given to spenders and borrowers. Because the Fed is slow to respond to their bubble there is a large wealth transfer that will disrupt current market institutions.

Saturday, April 1, 2023

Can you put a price on everything?

Michael Sandel, a Harvard economist, writes a breezy book What Money Can't Buy: The Moral Limits of Markets, which discusses the important question of the pricing of everything. Should your body parts be for sale? Are ticket scalpers providing a good service? Should we pay students to read books? Is it immoral to buy and sell death contracts? Is there something wrong with naming rights?

An economist can say there is a price for everything, but does that mean we should make all activity transactional? Are there moral limits on what we can put a price on? What are the limits to a pricing scheme?

There are a lot of questions that are addressed in this book which makes it thought provoking for a wide audience. One the one hand, there is efficiency with pricing all activities. If I want to see a concert, I should be able to pay a premium for someone to stand in line for me. A sports owner should be able to sell naming rights to their stadium. However, should I allow people to sell one of their kidneys? We have both volunteer and paid blood donors.

Sandel presents interesting cases where placing a price on a good changes the demand for it. Similarly, he also presents cases where people do not respond to economic and price incentives. Consumers do not respect as expected to higher or lower prices. We also do not get the result that we want from changing incentives. Our behavior is often adjusted by the process of pricing. The title discusses moral limits but there are cultural limits to how we look at the price of goods and service. Nevertheless, there is something very primal and efficient on trying to price everything.