Most psychology research is done on WEIRDos. Yes, testing is done on the WEIRD - Western, Educated, Industrialized, Rich and Democratic. Given that most of the research is conducted at leading universities in developed countries, there is a clear self-selection bias. Research conclusions are based on subjects that have world views that do not represent the majority of the world population. This has been pointed out more than a decade ago by Joe Henrich et al. "The weirdest people in the world".

This issue becomes especially important when we measure how WEIRDos look at and solve problems versus other groups or cultures. We are used to westerners who think about using analytic tools to solve problems. The WEIRD breaks problems down into individual parts. For example, when the WEIRD see pictures, they will look at individual objects and not the relationship or connection between objects. It is a culture thing. Eastern cultures will think more holistically and less about the individual. Of course, in spite of our openness to others, the hegemony of western culture pressures everyone thinks through the WEIRD lens. WEIRDness has implications for investment decisions.

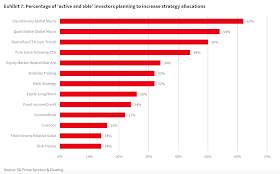

I would say that money management and hedge funds are dominated not by WEIRDos but by REAMers: Rich Educated Analytical MBAs. It has been a great investment advancement to have REAMers using their tools and skills to manage money with scale, but there is also something missing with their thinking. Solutions to non-analytic, non-textbook problems may be problematic for REAMers. A REAMer is likely to have problems with innovation. He or she will also have problems with market sentiment that does not fit within an analytic framework. REAMers will herd with others that have the same background. The relationship between politics and market behavior will be another area which will be more difficult to understand.

The comfort zone for REAMers will be with other REAMers, and they will have a difficult time acting in a way that is different from other REAMers. Not thinking like a REAMer is not being contrarian but viewing the world from a perspective different from what was taught.

This issue becomes especially important when we measure how WEIRDos look at and solve problems versus other groups or cultures. We are used to westerners who think about using analytic tools to solve problems. The WEIRD breaks problems down into individual parts. For example, when the WEIRD see pictures, they will look at individual objects and not the relationship or connection between objects. It is a culture thing. Eastern cultures will think more holistically and less about the individual. Of course, in spite of our openness to others, the hegemony of western culture pressures everyone thinks through the WEIRD lens. WEIRDness has implications for investment decisions.

I would say that money management and hedge funds are dominated not by WEIRDos but by REAMers: Rich Educated Analytical MBAs. It has been a great investment advancement to have REAMers using their tools and skills to manage money with scale, but there is also something missing with their thinking. Solutions to non-analytic, non-textbook problems may be problematic for REAMers. A REAMer is likely to have problems with innovation. He or she will also have problems with market sentiment that does not fit within an analytic framework. REAMers will herd with others that have the same background. The relationship between politics and market behavior will be another area which will be more difficult to understand.

The comfort zone for REAMers will be with other REAMers, and they will have a difficult time acting in a way that is different from other REAMers. Not thinking like a REAMer is not being contrarian but viewing the world from a perspective different from what was taught.

None of this should be surprising; however, investors need to have an awareness of their conventional thinking and accept that market behavior may be driven by those with a different framework. Market behavior that does not fit within a model may not be irrational. It does not fit in the world view we would like.