When Keynes discussed "animal spirits" and investments, it was not as a complaint about speculative excess but a commentary on the optimism necessary to make investment decisions when the future is unknown and cannot be easily measured. Investment decisions that have to last for five or more years are hard to discount. There is a process for finding the net present value, but determining the cash flows to be discounted is not easy and it will only be harder if there is greater geopolitical instability.

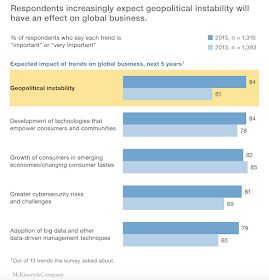

McKinsey's latest survey "Geostrategic Risks on the Rise", shows a significant increase in those who think that geopolitical instability will have a greater impact on their companies over next five years. McKinsey's catch-all for geostrategic risks, (geopolitical, political, and macroeconomic instability), shows this issue to be more important for all executives.

Executive believe these geopolitical risks will hurt their profitability, yet the same survey shows that less than 15% have taken any steps to address these issues. Additionally, the methods that have been used to address these risk are viewed by these same executives as ineffective.

I would argue that business executives have addressed these issues. They increased their cash levels and reduced their investment in new projects and people. Cash levels have been tax-driven, but given the low levels of interest rates, there should be more new projects being undertaken. This increase was expected from unconventional monetary policy. In reality, risks trump rates in determining whether there is a company investment. Animal spirits are not positive.

What doe this mean for macro investors? If executives are not prepared for these risks, the impact on companies will be significant and there will be a run to safety when the risks are realized. The demand for safe assets will increase and the managers who switch to bonds and away from risky investments will be rewarded. We have argued that this switch should be rules-based because when the risk events occur there may not be time to wait and see what happens.